What’s a great HECM Mortgage?

HECM signifies Household Security Transformation Mortgage, that allows older persons to extract helpful income out of their home collateral. Within the a beneficial HECM mortgage, the latest mortgagor’s family will get guarantee, as well as the loan try repayable only when the newest debtor finishes traditions on mortgaged assets often since they’re dead or have moved someplace else.

To conclude what is actually a great HECM financing, you could potentially spend the money you will get courtesy HECM to your something, however still have to afford the taxation on time and you may continue doing the latest servicing of your home.

Inside a traditional home loan, your collateral grows since you continue repaying the mortgage your debt. The goal at the rear of paying down the principal additionally the appeal will be to eventually get to be the complete owner of the residence.

At the same time, HECM mortgage allows you to borrow money predicated loans in Ansonia on your domestic equity. A majority of the elderly own their home, but unfortunately, of numerous have no idea one to their prominent resource could easily be a good way to obtain their later years money. Although you need not shell out month-to-month once HECMing their property, the loan matter develops in the place of decreasing in time.

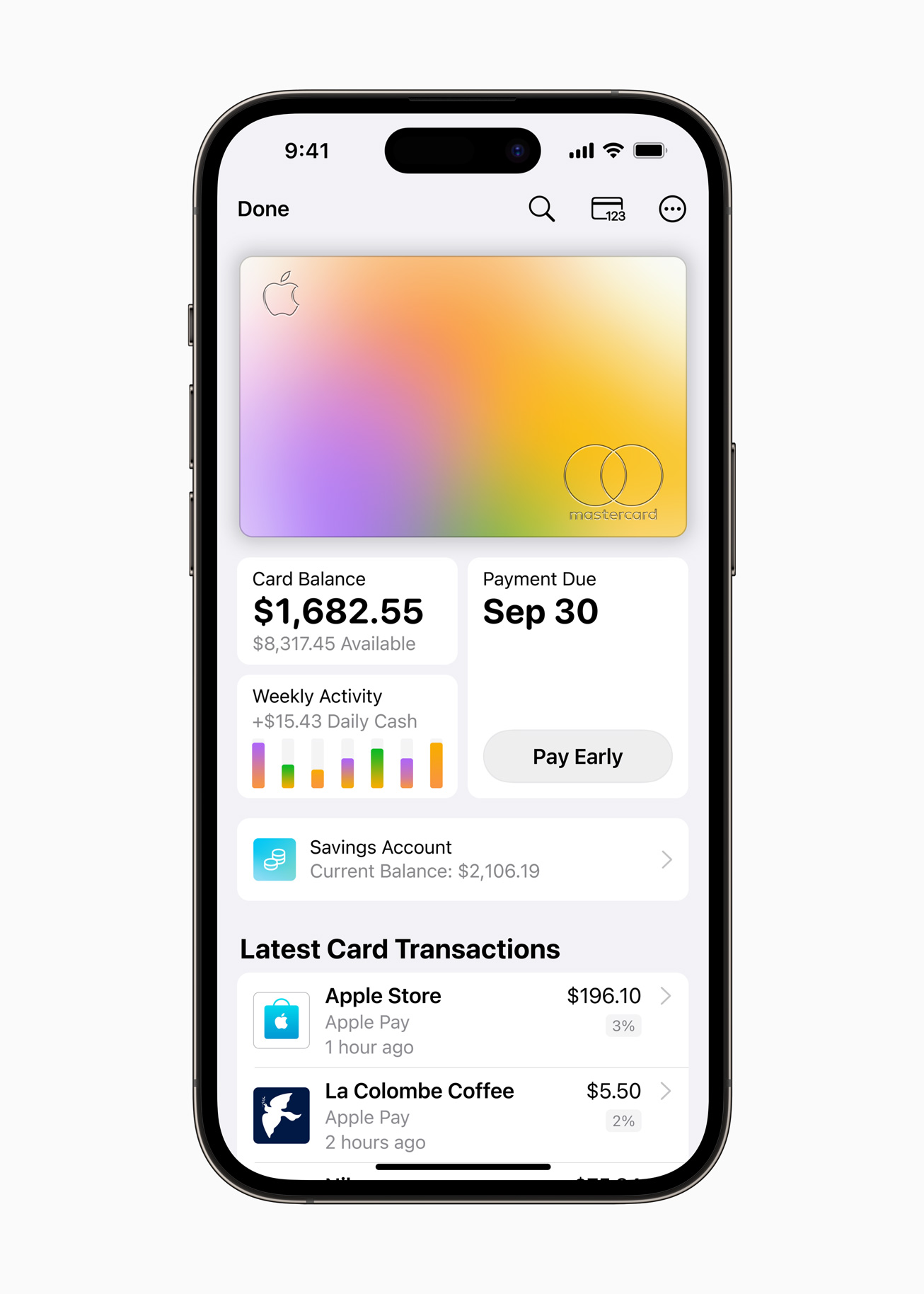

Into the a classic home loan, the financial institution or even the loan providers disburse the whole matter in a single wade right at inception to allow brand new debtor to acquire a property, while, HECM financial entails numerous institution. You can procure a lump sum, opt for monthly obligations, plus obtain much more in the event that need-be.

Once more, month-to-month repayments define basic mortgages, and be also expected to afford the a great equilibrium in the end. One of many USPs away from a face-to-face financial is the loan providers recover their cash only once, i.age. following debtor vacates the latest mortgaged assets or becomes deceased.

Very, How come an excellent HECM Financing Functions?

House Security Conversion Financial is completely with no complexities, as much as, the way it works is worried. Circumstances just like your decades, interest, in addition to property value your home will establish the mortgage matter. Earlier owners which have costlier house will have more substantial credit limit.

Interestingly, while you are hitched otherwise has actually a great co-candidate, the age of your lady or perhaps the co-borrower will determine the quantum of one’s dominating amount.

Attributes of a beneficial HECM Loan

Knowing what’s a beneficial HECM mortgage, you should investigate sophisticated has actually one HECM home loan keeps, many of which are listed below:

- If for example the mortgage eventually is higher than the value of your residence, you will not have to pay the real difference.

- With regards to the commission option you go having, you may ultimately become expenses zilch so long as you financial your property.

- There is no period, in addition to lenders may come in order to reclaim their money as long as you opt to dispose of otherwise vacate your house.

- The speed can vary, as often since each month.

Benefits of good HECM

Professionals aplenty when it comes to HECM Home loan and positively do have more grounds than just one when you decide in order to contrary home loan your own property. Here are a few of your secret benefits that you can get:

- One of the primary reason home owners choose an excellent HECM mortgage would be to pay an existing conventional home loan. By doing so, it make sure the duty of making monthly obligations cannot weighing on the brain.

- Your children and other heir can certainly inherit your residence post your death if you are paying off the loan.

- Paying the borrowed funds at the conclusion the word tend to imply you will have money to own unanticipated expenses such as scientific issues.

- HECM makes for outstanding plan. You can get to reside your property comfortably and you will enjoy a constant earnings also. When your loan amount exceeds the economic value of your property just after your own passing, government insurance rates pays off of the differences.

- Its entirely income tax-totally free, and spend nothing to the us government.

Eligibility and you may HECM Financing Requirements

It isn’t just your that has as qualified to find good HECM mortgage loan. Your home as well need satisfy particular requirements, so there are a couple of other personal debt that you need to getting conscious of to satisfy the new HECM mortgage requirements.

How come good HECM Loan Work below Various other Assets Sizes?

For the possessions so you’re able to qualify within the FHA’s HECM Reverse Mortgage program, your residence must belong to the fresh less than-said groups:

Characteristics that simply cannot avail HECM Opposite Home loan

When it comes to a HECM Reverse Mortgage, just remember that , not absolutely all characteristics is shielded around so it strategy. The fresh new HECM Reverse Financial system does not security:

The actual only real exception to this rule produced here is for rent land, in which a good HECM Contrary Mortgage system are going to be availed in the event your rental space try a multiple-device home or home, therefore the resident has actually occupied at least one of told you tools.

Bottom line HECM Mortgage is made so that this new old to invest its twilight age inside the tranquility through the help of the most effective resource. This may with ease suffice your own goal considering you think of all the facets and employ it intelligently.