Home owners will thought refinancing their house financial after they need certainly to remove costs. A good re-finance will get will let you get rid of private home loan insurance coverage, receive a lowered interest, shorten the length of your mortgage otherwise alter the kind of of financial.

Whether you need to refinance utilizes your aims. If you would like slash expenditures, you will have to influence the crack-also point to know if it’s even worth every penny. If you’d like use of cash, a home guarantee agreement (HEA) is much better than a cash-aside re-finance.

Given that process for your first mortgage, the latest re-finance procedure means you to afford the same fees, which include those people to have mortgage origination, household assessment, identity lookup and you will credit file. These types of charges can range out of 2 so you can six% of one’s full financing dominating.

Residents are likely always refinancing once the a phrase, but the majority of do not know exactly what the techniques requires. This guide so you can refinancing demystifies the procedure and you will teaches you your options.

Refinancing your property loan means that you will get an entirely the newest home loan. Just after in the process of the borrowed funds software procedure to suit your very first home loan, the idea of creating all of that once again probably sounds unappealing.

Refinancing, whether or not, is able to help you alter your mortgage’s interest rate or label. According to your targets, an alternative to refinancing tends to be right.

How-to refinance: let us flake out the procedure

You actually know a good amount of other home owners which financed the get loans in Sherwood Manor with home financing. They ily people has refinanced their property financing.

This guide so you’re able to refinancing fills this new gap ranging from everything already learn (the mortgage application procedure) and you can what you want to know (if you ought to re-finance).

Just what it way to refinance

So you can refinance your mortgage function obtaining a totally brand new home financing with many terminology you to definitely range from your existing mortgage’s words. Such as for example, you happen to be capable of getting a lesser interest, otherwise change your home loan off a thirty-year identity in order to an effective fifteen-year name.

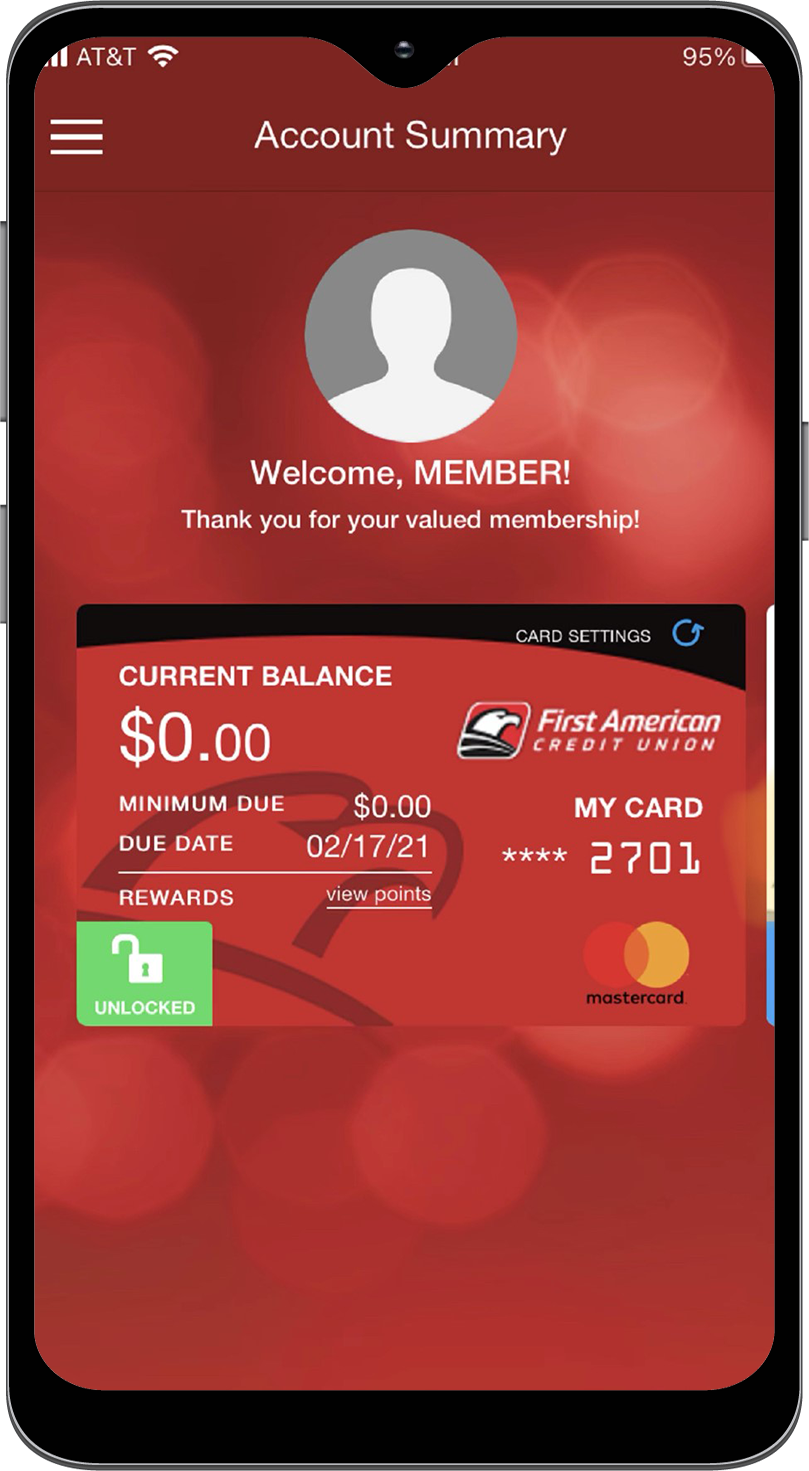

You might refinance with similar sort of company for which you received their very first financial: a private lender/bank, a national mortgage system or a card partnership.

The kind of refinance you decide on all depends partially on your own most recent financial. For example, if you have an enthusiastic FHA or Virtual assistant mortgage, the choices could possibly get a bit differ from someone having a traditional lender-recognized mortgage.

Speed and you can title: Your replace the interest or loan identity of your established financial, enabling that lose monthly premiums otherwise create equity faster or sometimes both.

Cash-away re-finance: You are taking away another type of home loan for a much bigger quantity of money than you owe on the current financial. You can make use of the extra dollars the mission.

FHA, USDA or Virtual assistant Improve re-finance: You’ve got gotten a home loan backed by one of those regulators programs. Therefore, the brand new FHA, USDA and you can Va for each provide a particular refinance system you could potentially imagine.

Opposite financial: This will be just as the dollars-aside refinance in that you will get currency for your needs. Consumers more 62 with plenty of domestic guarantee normally located monthly payments in the bank you to definitely gets its cash back if borrower makes or offers the home.

Whenever in the event the re-finance?

Eliminate personal financial insurance policies (PMI): For those who don’t create an adequate deposit (20%), your own home loan company likely expected that buy PMI. This will make your own monthly payment higher priced. Should your house’s worthy of have increased, your We.

Reduce the fresh mortgage’s identity: You might be capable turn their 30-season financial into an excellent fifteen-12 months mortgage in place of significantly affecting this new payment. For example, changing a 9% price to an excellent 5% rates would allow you to definitely spend a lot more a month into the your prominent in place of attract.