The very best challenge with respect to to purchase a property for the majority of Us citizens is insufficient advance payment. We understand rescuing to own a down-payment can appear challenging, however, at the Treadstone, we offer multiple finance which have low-down fee possibilities, and also a couple of which have no down payment! All of us helps you find the right program for your requirements making their dreams of homeownership possible.

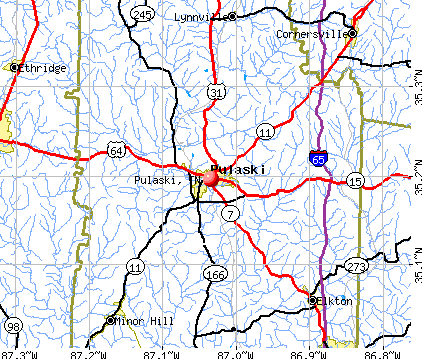

RD (Rural Creativity) Finance, also known as USDA Financing, is booked to possess number 1 houses in outlying parts. Certain standard criteria to own RD Funds is:

- Located area of the possessions

- Domestic income and asset constraints

- House must be the consumer’s no. 1 residence

Virtual assistant Fund is actually kepted to possess veterans and you may active duty service players, because the lay from the Service regarding Veterans Points. Specific general requirements to possess Virtual assistant Funds tend to be:

- Good COE (Certificate off Qualifications)

- Family ought to be the buyer’s primary household

What Michigan Mortgage Software Give Nothing Currency Off?

FHA Funds is backed by the us government (such as for example each other USDA and you will Va Funds) as they are a alternative with flexible eligibility conditions. FHA Money are to own no. 1 residences just and may feel better-fitted to borrowers who’ve a lower life expectancy credit score and require borrowing liberty.

Antique Funds is the most commonly known financial type in Michigan. Conventional Funds are the most versatile sorts of mortgage, and generally are useful in some products. So you can qualify for a decreased down payment option, customers have to slip within the income restriction in for this geographical urban area or perhaps be a primary-day family visitors.

The response to choosing your own down-payment count lies in your own finances! Homebuyers who wants to facilitate their property purchase see a zero advance payment alternative beneficial or needed.

Your deposit matter in person affects numerous areas of your loan- month-to-month mortgage repayment, home loan insurance policies, and you will limit approved amount borrowed to mention a few. The Treadstone Loan Administrator will help determine whether a zero down percentage financing suits you!

- Preserves more money inside the bank brief-name

- Is able to pick eventually

- Use discounts getting instantaneous solutions, renovations, otherwise decorating

- Zero-off mortgages often have might have highest rates of interest according to the mortgage system

Depending on the Michigan financing program your qualify for, minimal down payment can range regarding 0% to three.5%. The loan Administrator allows you to determine the best system getting your! Before this, check out additional info for earliest-date buyers.

What other Information Occur for Earliest-Time Homebuyers?

One of several perks ‘s the Michigan Basic-Day Customer Family savings. This is certainly an income tax-free family savings to own coming people, such an enthusiastic HSA otherwise 529 education family savings. Most of the money contributed to so it financial or brokerage account will grow and be stored without having any state fees due on the equilibrium or benefits. To learn more, see our guide to Michigan’s FHSA.

A unique cheer getting Michigan home buyers try MSHDA, an advance payment guidance program on the Michigan Condition Housing Creativity Expert. Qualified consumers you can expect to located $ten,000 during the advance payment direction fund used to have closing costs, pre-paids, while the deposit itself. MSDHA means a 1% minimum down payment throughout the debtor which will be an extra mortgage in your home with 0% notice. Such funds can be used for this new advance payment and you can/or closing costs. Concurrently, MSHDA’s down-payment help is only available on the homes cost under $224,500. To find out if you be considered as well as for more information, contact a Michigan Mortgage Officials!

I want to set-out only you can easily; just what program is the best for one to?

There are many mortgage applications that need virtually no down money. Get hold of your Financing Officer to see just what program you can even be considered to own hence suits you best. Remember that most of the household instructions provides closings will cost you and you will prepaid can cost you along with the advance payment.

The straightforward respond to: it depends! Within Treadstone, you’re over your credit score, and you may our Loan Officials could work along with you on your book problem.

Options are minimal, however, we like to track down creative. Particular no credit check installment loans Fresno apps get enables you to get another house or apartment with nothing money off, however, while the each person’s circumstance is different, there’s absolutely no that-size-fits all. Miss all of us a line and we’ll perform all of our better to performs one thing away!