You.S. Agencies of Farming (USDA) finance and you will Federal Property Government (FHA) finance keeps equivalent, yet collection of requirements. USDA funds are especially to have lowest- in order to moderate-earnings families inside rural elements, just like the FHA program try accessible to anyone, no matter what certain finances or a beneficial home’s geographical location.

FHA Funds Possess High Money Limitations

USDA loans merely sign up for people who have moderate so you’re able to lower revenue, relative to their components. There’s two applications provided by the USDA, for each and every with independent money conditions: Their Guaranteed Financial program try maintained from the a lender, such as for example Figure Financial, and masters moderate-earnings individuals. Its Direct Financing program try maintained by the USDA, and you will available to lowest- and extremely-low-money individuals.

The easiest way to see if youre qualified is to try to utilize the USDA’s on the internet Unmarried Family members Houses Earnings Eligibility product. Only discover variety of home loan you’re interested in at the the top monitor, and choose new property’s place.

Functions Need to be As well as Sanitary

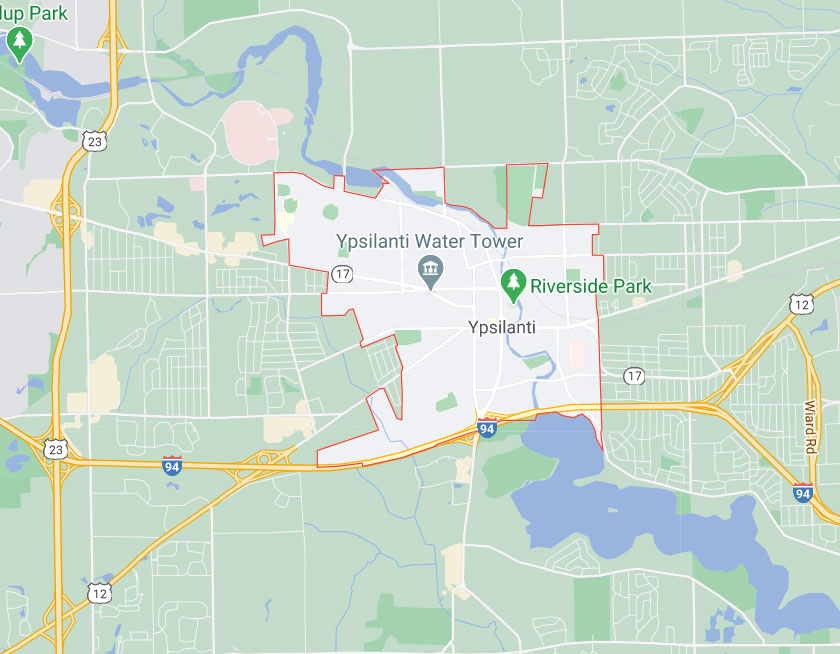

The latest USDA system was created particularly for residential district and you may outlying-fool around with cases, therefore it is only relevant having characteristics within the lower-populace portion. These guidelines are normally taken for town so you’re able to area, so that the most practical method and see if your possessions qualifies try to evaluate from the aforementioned eligibility equipment, otherwise check with your representative. Keep in mind: You simply can’t purchase property in the center of a metropolitan city, such New york!

So you can meet the requirements, brand new home should be just one-home and you may considered as well as hygienic, a determination produced by a state-authorized family inspector. Once the real requirements vary from state to state, it is regular towards inspector to evaluate the next to own correct function:

- Plumbing work, Liquids & Sewage

- Heat & Air conditioning

- Electric Assistance

- Architectural Soundness

Your house may you want a termite examination to ensure they doesn’t have any wreck otherwise infestations, however, it stipulation should be waived, according to the condition.

The new FHA program also has minimal possessions conditions specified from the You.S. Company out of Casing and you can Urban Innovation (HUD). A HUD authorized inspector have a tendency to run a stroll-compliment of and you may assessment process to determine brand new home’s well worth and you can cover.

There is certainly a particular list the latest appraiser have to verify, which has a number of the same situations since the USDA evaluation. If the family needs some repairs, it is far from problematic on https://paydayloansconnecticut.com/candlewood-shores/ the FHA, due to the fact they are these on home loan. The difficulties simply cannot be things biggest, such as for example a broken base, such as for example.

FHA Borrowing from the bank Standards Try Lenient

Of the two applications, FHA finance have the far more lenient credit history standards. Consumers ranking less than 579 can acquire acceptance, but might need to developed an excellent 10% down-payment. 3.5% off costs is actually you are able to, but want a credit rating of at least 580.

USDA fund be a little more usually received by individuals having a rating more than 640, even if applicants with a lower life expectancy score can be approved, to your circumstances-by-case foundation.

Even in the event each other applications provide house-people low down money, the USDA victories within this classification. They permit borrowers so you can safe mortgage loans with no money up front, oftentimes. A decreased deposit given by the newest FHA was an effective step three.5% selection for individuals that have a credit rating more than 580.

FHA Possess More expensive Insurance

Both apps need right up-top, yearly charges given that insurance policies on mortgage, also the regular focus repayments, as the specific costs vary.

The fresh new USDA requires a right up-side payment of 1% of loan well worth and you can an extra 0.35% of your own mortgage worth every year, while the FHA demands a 1.75% 1st percentage and you will anywhere between 0.45% and you will step 1.05% annually.

The newest regards to the interest to your a couple differ. FHA fund usually have insurance premiums-even with a beneficial 20% or higher down-payment-however the costs straight down because down payment increases. USDA fund only require Personal financial Insurance coverage (PMI) if the borrower leaves below 20% down, as well as the insurance coverage repayments will minimize when the debtor enjoys paid off 20% of price.

Rates of interest are different by lender, but could wade as little as 4% for FHA loans, and as low as the 3.25% getting USDA mortgages, as of very early 2019.

USDA Is the most suitable to have Outlying Parts

Which of these software is most beneficial? It depends where you live. Whenever you are probably going to be purchasing property for the a rural city, the newest USDA system typically also provides greatest rates, with reduce payment alternatives. As ever, before making a decision, you ought to keep in touch with an experienced lender. Get in touch with a bend Large financial company, today.