When contrasting lenders and you will mortgage options for safeguarded do it yourself finance, you will need to thought numerous affairs. Start by contrasting interest levels and you will financing terminology offered by different lenders. Come across lenders with a decent reputation and you will positive customer feedback.

Simultaneously, verify that he has expertise in bringing fund specifically for household improvement tactics. Think about the restriction loan amount and eligibility standards to ensure they line up with your means. Don’t neglect to take a look at the conditions and terms and you will understand any fees otherwise penalties from the financing. By doing comprehensive browse, there are a loan provider that offers competitive conditions and you can caters to your own recovery requires.

Gather Requisite Data

Whenever making an application for covered do it yourself fund, meeting the required data files was an essential step. Loan providers typically request evidence of income, for example pay stubs otherwise tax statements, to evaluate your ability to settle the loan.

As well, they may consult economic statements, bank statements, or employment verification letters. Almost every other crucial files become personality evidences, property ownership data, and you may insurance policies advice. Having this type of data in a position ahead have a tendency to facilitate the borrowed funds application processes while increasing your chances of recognition. When you are structured and you will providing the required paperwork, you show debt stability and commitment to https://paydayloanalabama.com/thorsby/ your panels.

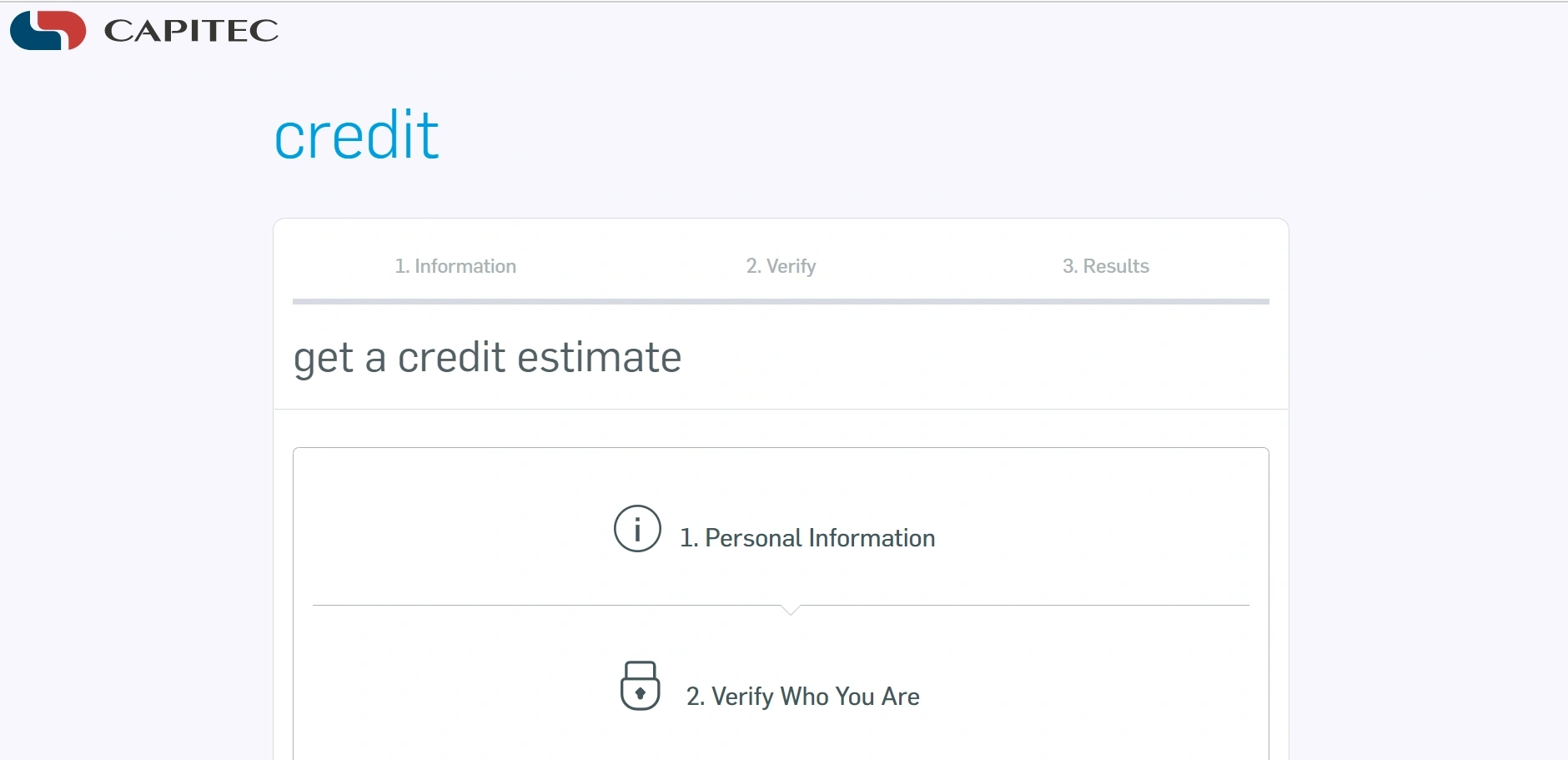

Submit The loan Application

When submitting your loan software to own a protected do-it-yourself financing, precision and completeness are essential. Provide most of the called for papers and ensure it is right up-to-day. Double-check the software for your errors or lost recommendations that may decelerate the process.

Concurrently, be ready to address any questions otherwise render subsequent records when the asked from the financial. Think of, a well-waiting and you may thorough application grows your odds of approval and you will expedites the borrowed funds techniques.

Guarantee Standards

- Secured loans for do-it-yourself typically wanted equity to secure the mortgage.

- Collateral would be in the way of a secured item like your house, a car, if not a family savings.

- The worth of the brand new security will determine the mortgage amount you qualify for.

- Loan providers could have certain recommendations about your type of and value out of collateral it undertake.

- The new security provides defense on financial should you standard into mortgage.

- It’s important to carefully think about the security your promote and make certain their worth aligns together with your loan criteria.

- Keep in mind that the equity are on the line if the your don’t build loan money.

- Usually comment the fresh equity standards with assorted lenders to discover the most readily useful conditions and options for your residence improve endeavor.

Credit history and you will History

Your credit rating and you can record gamble a life threatening part whenever using for secured loans to have home improvement. Lenders make use of this suggestions to assess their creditworthiness to see your own financing terminology. Increased credit score usually leads to top financing now offers, as well as down interest rates and large mortgage number. At the same time, the lowest credit history will get curb your options and you will cause highest rates.

Maintaining a credit history by creating costs timely and you can keeping your credit use reasonable is essential for protecting favorable loan words. It is advisable to look at the credit report regularly to understand any mistakes or discrepancies which could apply to your loan software.

Evidence of Earnings

So you’re able to safer a house upgrade mortgage, taking proof of earnings was a critical requirements. Lenders you would like warranty you to definitely borrowers has a steady and you may sufficient supply cash to meet up with its repayment loans. Below are a few basic recommendations on getting proof earnings:

- Shell out stubs: Tend to be current spend stubs that demonstrate your seasons-to-go out income.

- Taxation statements: Fill out your tax statements for the past 2 yrs showing uniform earnings.