Forbearance

Forbearance is similar to a deferred commission package. The difference is the fact as opposed to deferring unpaid repayments, you could potentially suspend all of the payments up to a later date. Particularly a good deferred payment bundle, you must plus show that you are experiencing a temporary difficulty. Just as in good deferred fee bundle, the borrowed funds continues to accrue interest, that will need to be paid off following forbearance months try more than.

Short Sales

A preliminary purchases can possibly prevent property foreclosure in your domestic, but you will nonetheless eliminate they. Throughout the a short selling, our home is sold for less than what exactly is owed with the the borrowed funds. The united states Lender requires individuals to show that they are experiencing challenges prior to they will certainly commit to an initial deals because they will not recover a complete number of the loan. If you’re unable to spend their home loan and other expenditures, or if you must sell your home however are obligated to pay a lot more on financial than it is well worth, a short revenue could be recommended.

Action in place of Foreclosures

After you prefer a deed in lieu of foreclosure, you give the financial brand new action to your residence and also in replace, they don’t foreclose on your own domestic. Once again, you are going to need to vacate your house but you’ll not face most other consequences out of property foreclosure, eg a bringing down of your credit history.

Issues Against Us Bank

There are of many issues up against United states Financial. From inside the 2018, men away from Brooklyn is actually prosecuted having foreclosures. Their courtroom people after learned that You Financial didn’t actually individual the mortgage and therefore, had no courtroom status in order to document a foreclosure lawsuit. The fresh new court in the event not merely considered the newest property foreclosure suit are frivolous, but the guy as well as ordered the financial institution to invest $ten,000 inside sanctions.

The aforementioned situation happens more frequently than somebody envision. Loan providers often package mortgages to each other and sell these to almost every other lenders. When they do this, it not have any need for the property and should not foreclose towards the resident.

In another issue, a female regarding Illinois alleged one to You Financial got contacted her every single day after they rejected their particular loan modification and you can already been the foreclosures techniques. Calling people inside the a harassing trend, also calling them endlessly, try an admission of your own Cell Individual Protection Work (TCPA). It was an individual pass of the TCPA the fresh lawsuit alleges. This woman is this new plaintiff inside the a category step lawsuit. This woman is trying to $1,five-hundred during the damage for every pass, in addition to all call produced.

- Continuing with an initial marketing or property foreclosure while your loan amendment are around review, a technique called Twin Record, that’s prohibited,

- Not wanting to review otherwise honor the loan modification,

- Failing continually to respond to your application for a loan modification in this thirty days,

- Not wanting to simply accept your own home loan reinstatement otherwise homeloan payment, and

- Saying that you are in standard and harmful foreclosure once you commonly about in your loan money.

In the event that You Financial has https://paydayloansconnecticut.com/daniels-farm/ actually registered a foreclosure lawsuit up against your, it’s important to speak to our Fort Lauderdale foreclosures protection attorneys immediately. In the Mortgage Attorneys, we have extensive feel dealing with United states Lender and we will set one to solutions working for your requirements. Call us now in the (954) 523-4357 or complete our very own on the internet form so you can demand a free of charge overview of the circumstances having our attorneys and get the full story.

- Concerning Blogger

- Newest Listings

Mortgage Solicitors comprises of knowledgeable consumer legal rights lawyer which play with every readily available capital growing total obligations service steps. All of our purpose is always to deal with those burdens, handle the individuals trouble, and enable our very own subscribers to sleep soundly knowing he could be on the the road in order to a much better coming.

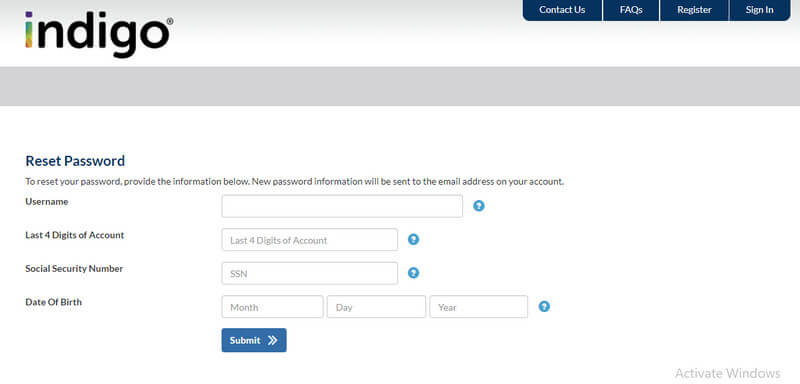

In order to put off payments with our company Financial, you need to satisfy one or two eligibility conditions. The very first is your home loan should be outstanding between 30 and 60 days. The new outstanding reputation should have been already undamaged for around 90 days.