Immediately following starting a free account, try to provide specific personal data to complete brand new software procedure. Credit Karma means facts just like your full name, date regarding beginning, and you will societal safety number.

Giving Permission to have Credit file Availableness

You happen to be asked to give Borrowing Karma permission to view your credit history out of TransUnion and you will Equifax as part of the software process. This is certainly crucial for Credit Karma to add precise credit ratings and individualized pointers centered on the credit character. Giving consent allows Borrowing from the bank Karma to help you recover their borrowing information securely and you will efficiently.

When you over these types of actions, you’ll properly sign up for Borrowing from the bank Karma functions. It is critical to keep in mind that Credit Karma’s qualities is actually subject so you’re able to eligibility standards, and not all pages is eligible for certain has actually. Although not, Borrowing from the bank Karma’s affiliate-friendly platform allows you for folks to access and would their economic guidance to get to the goals.

This new Credi Karma App

The financing Karma application is present to have Android and ios and you may was an incredibly easier way to place your suggestions at the hands. You might immediately supply your credit rating and see people recent changes.

You can access label and credit monitoring; your own Borrowing from the bank Karma Cut and you will Pend membership, offers, economic calculators, articles plus come through the software.

Acceptance Chance and Restrictions

While using the Credit Karma, it’s important to see the characteristics out-of acceptance potential in addition to restrictions in the them. Approval opportunity provided by Credit Karma are going to be regarded as a keen guess and not a promise away from acceptance for all the economic unit or service.

The nature out-of Recognition Chance

Acceptance odds are determined by taking a look at circumstances such as credit score, income, and financial obligation-to-earnings ratio. Such it’s likely that computed considering study provided to Borrowing Karma by loan providers and they are designed to provide pages a concept of their odds of recognition.

Affairs Impacting Acceptance Chance

Multiple factors is also determine acceptance odds, also credit history, commission history, borrowing from the bank utilization, therefore the particular conditions of your own financial. It’s important to note that for every single bank has its own standards having choosing approval, and they standards may differ rather.

Credit history

Your credit score plays a crucial role when you look at the deciding their acceptance opportunity. Generally, a high credit rating expands your chances of recognition, when you find yourself a lower credit rating can lead to straight down opportunity.

Commission Records

Which have a reputation to the-time money can absolutely impact your own recognition chances. Lenders like individuals with demonstrated responsible payment conclusion regarding the previous.

Credit Application

Lenders plus account fully for your credit use proportion, the portion of available credit your currently using. Preserving your credit utilization reduced is replace your recognition chance.

Bank Standards

For every single financial set a unique conditions to own approval, which may is lowest money account, work record, or specific credit rating thresholds. It’s important to feedback these types of conditions before you apply your economic equipment.

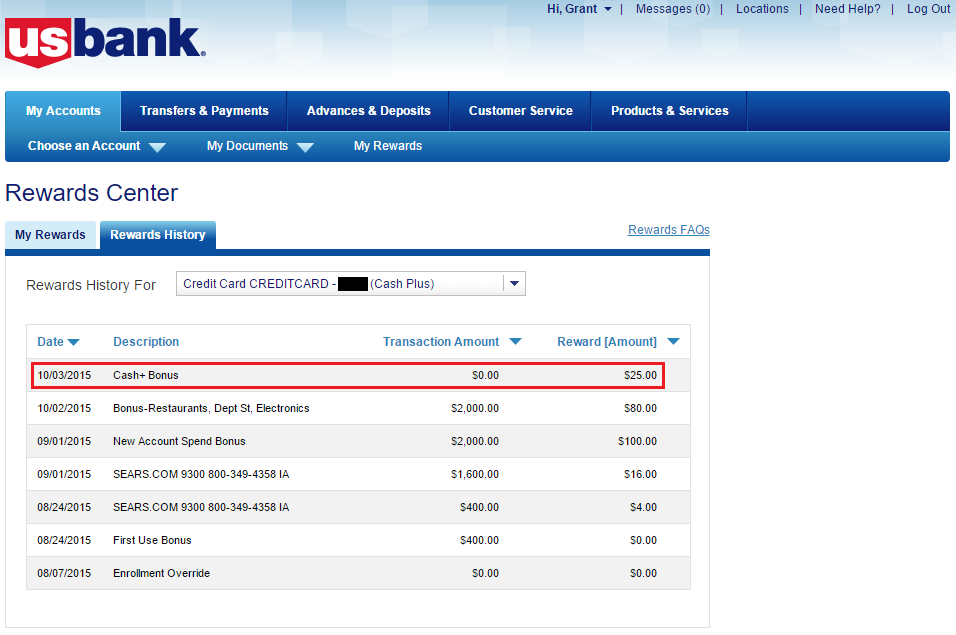

Expertise Artificial Photo

From inside the Borrowing Karma app, you may come across simulated images portraying possible offers or mortgage terms and conditions. These images is made getting illustrative objectives simply and don’t represent genuine offers. He is built to promote profiles a graphic signal and may not be mistaken given that genuine-time otherwise guaranteed offers.

You will need to realize that these types of simulated photographs are supposed to revise and inform pages concerning choices they may come upon. The brand new terminology and will be offering obtained may vary considering individual factors and you will lender criteria.

Bottom line, when you’re Borrowing from the bank Karma’s acceptance odds can provide valuable insights in the likelihood of acceptance, they should not be regarded as definitive claims. Saks same day loan It’s important to think about the several activities you to dictate approval, comment bank standards, and work out advised conclusion centered on your specific monetary profile.