Financial support your new structure family

Immediately after signing new creator offer, signing the structure options, and handling any upcoming land details, the second essential step is always to speak about their home loan choice. Generally speaking, a few months prior to your new residence is finalized, you are going to talk to a lending company and you will discuss any requirements in order to safer a home loan. They will crunch particular quantity and provide you which includes mortgage issues that may rely on the advance payment, credit character, or any other circumstances.

A great number of builders today provide the capability of in the-house money alternatives as a consequence of their credit divisions. Such as, communities created by Toll Brothers may link you which have Toll Brothers Mortgage. When you find yourself indeed introducing use the builder’s well-known bank, you may be significantly less than zero responsibility to achieve this.

Nonetheless, it’s crucial to talk to multiple lenders to ensure you make one particular told solution to meet your specific capital demands.

While to acquire a property within this a preexisting community (in place of to get belongings and you can strengthening our home found on your own), you are going to typically proceed with the exact same financial processes as the to shop for a selling home.

This requires protecting a home loan, that can be a fundamental conventional home loan or a federal government-backed loan like FHA, USDA, or Va, based your needs and you may qualifications. Its not necessary so you can safe a casing loan inside state.

Although not, it’s worthy of absolutely nothing you to definitely going for a beneficial builder’s financial will come having specific advantages, like unique incentives particularly closure loans if not a mortgage rates buydown

Once you plus home mortgage officer determine the most suitable loan alternative, possible come together to help you enhance the closure dates with the creator. Keeping open outlines off communications is crucial, as closing dates from inside the the framework programs normally move. It is really not uncommon to own build delays, especially offered people procedure or work shortages we have seen blog post-COVID.

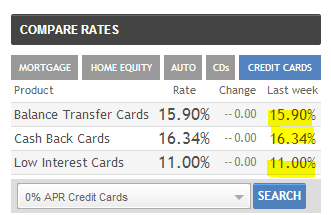

Within the a surfacing interest rate environment, it’s always best to proactively secure your own financial speed better during the advance of your closing. The only real potential hiccup you can stumble on are people unforeseen design delays. In addition, if the interest levels was in fact continuously losing, it may be smart to decrease securing on the speed up until before closure. Regardless of the prevalent market criteria, you need to talk to your bank period prior to your own booked closing and you will talk about the choices to support the really favorable interest rate you’ll be able to.

To order a separate structure home features its own group of pros and you can drawbacks, each of that can somewhat effect your overall homeownership feel. Here are the benefits and drawbacks of this to find a newly constructed domestic from a creator:

- You reach transfer to a never-lived-in home

- You could potentially personalize our home for your layout and needs (in the builder’s design parameters)

- Protecting a beneficial pre-structure domestic price increases the possibilities that your particular home tend to enjoy inside the worth once you execute the acquisition

- You love assurance with an assurance provided by this new creator

- You may need to waiting 12-two years on end of one’s new home

- Investing in a long-term construction investment can result in higher cost by the point from closure

- You are going to probably incur even more costs beyond bad credit installment loans Kansas the house’s legs price, and structure improvements, electronic work, and you can landscaping

- You may find on your own way of life within a casing website for a few days if you don’t many years, whenever you are one of several early customers in the community

- Whenever you are modification can be done, it is contained in this defined limits. You’ll generally pick from a selection of choice in lieu of which have limitless design versatility