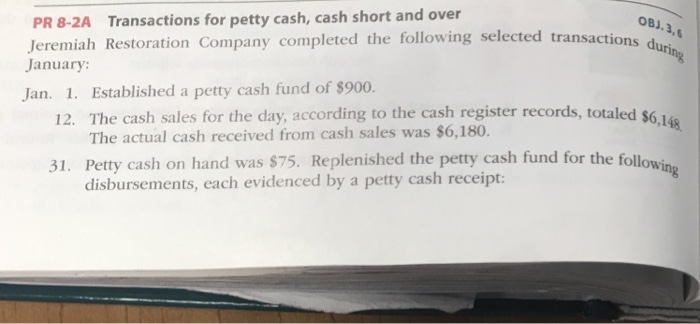

Editorial Guidance

You might refinance a mobile where you can find spend less however, you prefer getting willing to plunge by way of specific hoops before you can close. Stick to the four actions below in order to navigate the road towards top mobile household refinance if you possess a mobile domestic, manufactured household otherwise a modular family.

Step one: Understand what types of cellular house you possess

- Are designed land (MH getting small) are produced during the a plant and you can transferred to a site (usually belongings you possess) the spot where the sections are come up with into the a permanent basis.

- Mobile property, for credit purposes, is formations made in factories ahead of Summer fifteen, 1976 having axles and you can wheels got rid of in advance of getting apply leased homes. The definition of manufactured family usually makes reference to a cellular home-built immediately following Summer 15, 1976 in the home loan lending business.

- Modular house, often referred to as systems-created homes, try constructed from inside the a managed environment just before becoming shipped to your own house. They are make adopting the exact same strengthening requirements because webpages-established property and you will forever connected to house you possess.

- The home was at the very least a dozen legs broad having 400 square feet regarding living area, according to system

- Our home try permanently attached to help you a foundation and you will taxed while the real-estate

- The structure has the Institution of Houses and Urban Innovation (HUD) degree term, a HUD analysis plate, a HUD close otherwise MH Virtue sticker verifying your house has actually possess just like site-established house and you will/or suits shelter and you may livability standards lay because of the HUD

Step two: Determine if you reside real estate

Loan providers typically give you the most acceptable mobile domestic refinance alternatives on homes which might be experienced real-estate. The newest dining table below suggests the difference between a pattern which is sensed houses or individual possessions (referred to as chattel in the manufactured home lending world).

Step 3: Find the sort of refinance for the are available family

For many who very own a created domestic toward a long-term basis, or you happen to be refinancing to convert your property to houses, you’ve got around three options:

- Minimal cash-out refinances. A limited bucks-away re-finance enables you to pay off your home loan, move on the closing costs and are the design fees recharged to connect your residence to your belongings. A new cheer: You could potentially pocket a supplementary $dos,000 or dos% of your own equilibrium of one’s the fresh new financial, any are smaller.

- Cash-away refinances. If you have had your current household and you will house for at least 1 year, you could potentially borrow more than your currently are obligated to pay with a new home loan and you may pocket, or cash out, the difference. Normally, you can’t obtain as often of your own house’s value (also known as your loan-to-value (LTV) ratio) that have an earnings-away refinance into the a produced household as you are able to with a good non-are formulated family.

- Improve refinances. Are manufactured people having a loan backed by brand new Federal Housing Management (FHA), You.S. Agency regarding Veterans Activities (VA) or the You.S. Agency out of Farming (USDA) s usually don’t need earnings documentation otherwise an appraisal. Specific popular streamline applications are the FHA streamline plus the Virtual assistant rate of interest reduction refinance mortgage (IRRRL).

Step: Choose the right loan program to suit your mobile home refinance

You’ll want to document your income, property and you can borrowing and often you need an appraisal to ensure your residence’s well worth. In case your residence is believed houses, you might select the second system so you’re able to refinance a manufactured home:

Antique financing Federal national mortgage association and you may Freddie Mac computer place the rules to own old-fashioned funds, which happen to be preferred to own individuals which have a good credit score scores and you will reasonable debt-to-earnings (DTI) ratios. Settlement costs usually are less than government-backed apps and when you may have 20% or maybe more equity of your home, old-fashioned refinance loans don’t require home loan insurance rates, and that repays the financial institution for individuals who standard on the financing.

Regular FHA fund Insured by the Federal Casing Government (FHA), FHA loans bring autonomy getting individuals which have low credit scores and you will large personal debt rates. FHA-approved loan providers counterbalance one to chance by recharging FHA home loan insurance regardless from how much cash guarantee you really have.

FHA Name I fund While pleased with your current financial, but you want additional money for home improvement plans, you could acquire around $twenty-five,090 in case your home is property. In case your are made domestic sits with the leased homes, you should buy to $7,five-hundred.

FHA streamline refinance Are available people having a recent FHA financing get meet the requirements to re-finance without income data or a property assessment. not, you will have to plan for settlement costs otherwise thought a zero-closing-pricing refinance alternative – you simply cannot roll bank and you will name costs into loan amount about system.

Va money The fresh new You.S. Department of Experts Factors (VA) backs Virtual assistant funds to help you active-obligations and you can seasoned army individuals and eligible enduring spouses. One to downside in order to Virtual assistant fund to possess are formulated land: The most label is twenty five years and you may thirty-two weeks when payday loan Vredenburgh you’re refinancing a cellular family and you can homes package.

Va IRRRL You can change a preexisting Va loan with a great the latest Va financing as opposed to money records otherwise an assessment if you find yourself entitled to a good Virtual assistant IRRRL. However, in the place of the newest FHA improve, you could potentially roll your closing costs with the loan.

USDA money Meant for reasonable-income individuals to shop for land inside rural portion, the brand new You.S. Institution off Farming (USDA) guarantees loans produced by USDA-recognized loan providers. You cannot cash-out any additional collateral which have an effective USDA are designed mortgage.

USDA streamline Eligible individuals which have a current USDA mortgage line let system. Like the other regulators improve applications, there’s absolutely no money or worth verification criteria.

*Virtual assistant and you will USDA assistance try not to lay a credit score minimum, but the majority loan providers explore 620 having Virtual assistant and 640 to own USDA while the a basic.

Step 5: Go shopping for an informed are built mortgage rates and conditions

Get in touch with no less than three to five various other loan providers and make sure you may well ask all of them to own a made domestic price quote. If you use an online assessment rates tool, be sure to get a hold of were created home as property form of. Re-finance costs to own are available land tend to be quite more than typical residential property and lots of loan providers usually do not give resource to the are built house whatsoever.

When you choose a lender, keep in touch together with your mortgage officer and start to become in a position that have papers regarding their are made home if for example the domestic appraiser needs they. If you find yourself refinancing to transform a manufactured home to real estate, secure the financial rate long enough to afford time it takes to attach your house on base.