User Conformity Frame of mind: Third One-fourth 2013

From the wake of overall economy, house possessions values refuted rather in many areas. In response, of several loan providers suspended house guarantee lines of credit (HELOCs) or shorter credit restrictions, doing conformity and you may fair financing risks. While houses prices has rebounded regarding the downs of the drama, financial institutions need to still be mindful of its debt less than Control Z when a life threatening decline in a beneficial property’s really worth you to definitely greeting a collector when deciding to take these steps has been healed. Loan providers must also admit the fair credit exposure associated with these types of steps. This post brings an overview of the fresh new conformity requirements and risks when a collector requires action to the good HELOC because of a great change in worth of. step one

Controls Z Compliance Requirements

Element of Regulation Z imposes extreme compliance requirements towards HELOC financial institutions. https://cashadvanceamerica.net/loans/no-phone-calls-payday-loans/ That it area not simply requires disclosure from package conditions and terms also essentially prohibits a collector regarding modifying them, except in given affairs. That situation helping a creditor so you can suspend a beneficial HELOC otherwise lose its borrowing limit happens when the home protecting the fresh HELOC event a serious decrease in value, since given inside twelve C.F.R. (f)(3)(vi)(A):

No collector will get, by offer if not … alter one term, except that a collector could possibly get… prohibit a lot more extensions out-of credit or slow down the borrowing limit applicable so you’re able to an agreement throughout the one several months where in fact the property value the dwelling you to secures the master plan refuses rather underneath the dwelling’s appraised really worth to own reason for the plan. dos (Importance extra.)

The control will not explain an effective significant decline. Yet not, Feedback (f)(3)(vi)-6 of your Authoritative Personnel Remarks (Commentary) provides creditors that have a safe harbor: When your difference between the initial credit limit and also the available collateral is quicker by 50 percent due to a worth of refuse, this new refuse can be considered high, enabling financial institutions to help you refute a lot more borrowing from the bank extensions or slow down the borrowing from the bank restrict to have an effective HELOC bundle.

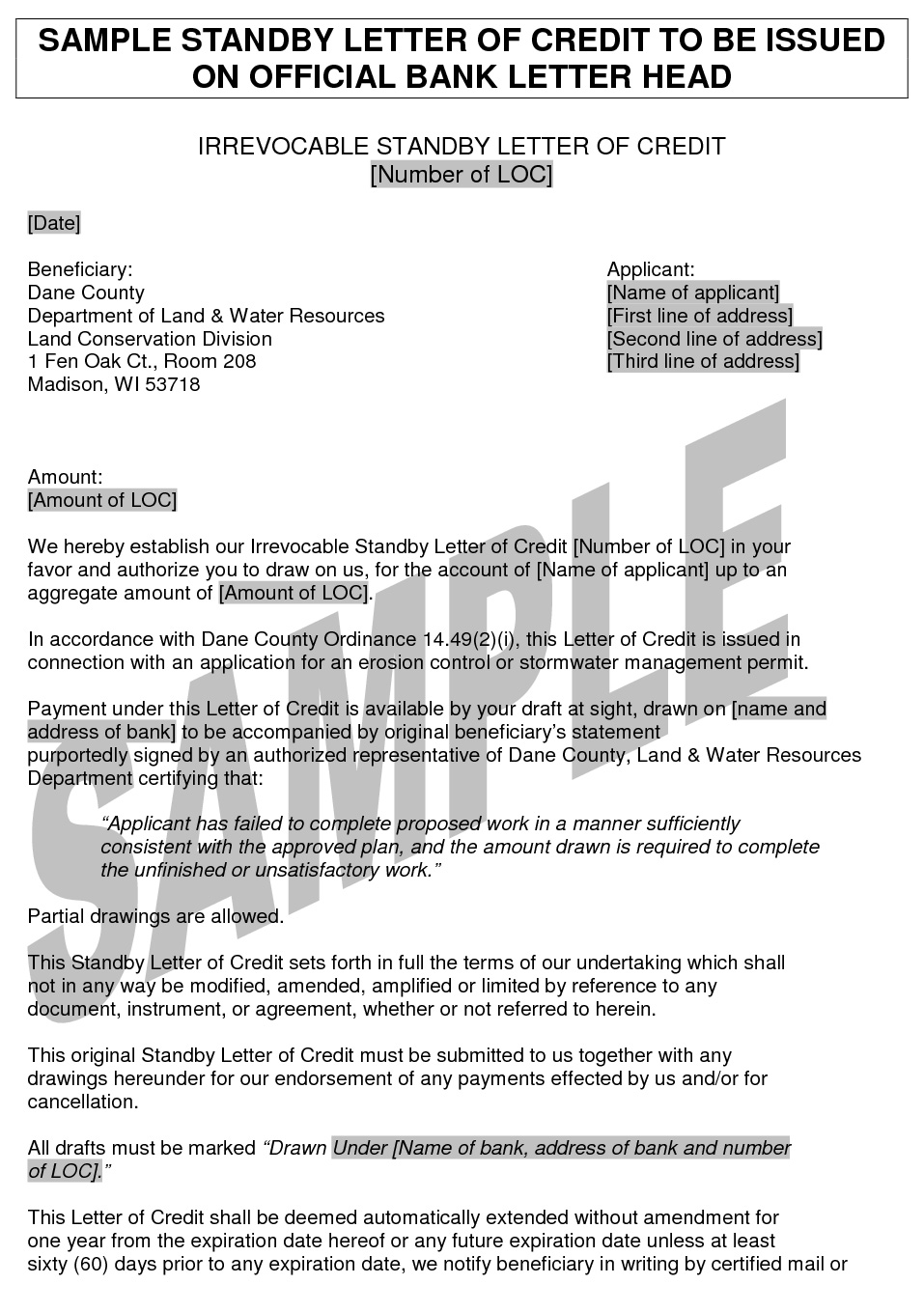

Whenever choosing if a serious decline in worth has taken place, loan providers would be to evaluate new dwelling’s appraised worthy of at the origination against the most recent appraised value. The fresh table lower than will bring an illustration. step 3

Inside analogy, brand new collector you can expect to exclude subsequent advances or slow down the borrowing limit if your worth of the house or property refuses off $100,000 so you can $90,000. Administration should be aware you to definitely although they is permitted to reduce the borrowing limit, this new prevention cannot be underneath the level of brand new a good harmony if performing this would need an individual and also make a top fee. cuatro

Worth of Steps

Brand new collector is not needed to get an assessment prior to reducing otherwise cold a beneficial HELOC when the family really worth keeps decrease. 5 But not, having examination and you will recordkeeping motives, the fresh new creditor is retain the paperwork where they relied to introduce that a serious lowering of worth of taken place before taking step into the HELOC.

During the , the Interagency Borrowing Chance Administration Recommendations to own Home Guarantee Financing was typed, which has a discussion regarding equity valuation management. six This new information provides examples of risk government strategies to look at while using automatic valuation habits (AVMs) otherwise income tax evaluation valuations (TAVs). After that advice on compatible strategies for using AVMs otherwise TAVs is given in the Interagency Assessment and you can Testing Guidance. 7 Administration may want to think about the recommendations when using AVMs or TAVs to determine if or not a critical refuse keeps occurred.

Also regulatory conformity, establishments should know about one a good amount of classification step provides was basically submitted challenging making use of AVMs to attenuate credit constraints or suspend HELOCs. 8 Brand new plaintiffs in these instances keeps confronted various areas of conformity, for instance the accessibility geographical area, in the place of private possessions valuation, as a basis getting good lender’s seeking regarding loss of really worth; the new AVM’s precision; and also the reasonableness of the appeals process in position where a borrower can get issue the latest decrease in the fresh line of credit. Into the white regarding the litigation risk, the crucial thing getting associations to pay attention in order to conformity requirements.