We make the fret from the home loan research processes to have all of our website subscribers to really make it easier to find a very good family mortgage inside the Quarterly report. With over forty lenders and you may 100’s of products available, selecting the most appropriate holder filled or resource financing is established easy with our software one to connects to the banks.

Revealing the fresh objectives of financial predicament both for the brand new short and you may long haul, enables us to obtain an obvious image of your circumstances in order to treat fees and charge and loan providers financial insurance rates (LMI) will set you back.

As part of our totally free solution, we will present an entire mortgage research inside Sydney describing the best financial pricing and you may assessment pricing. We are able to together with indicate your genuine costs having fun with a cost calculator or take into consideration any extra payments and you can latest loan amount in the event that using a counterbalance account.

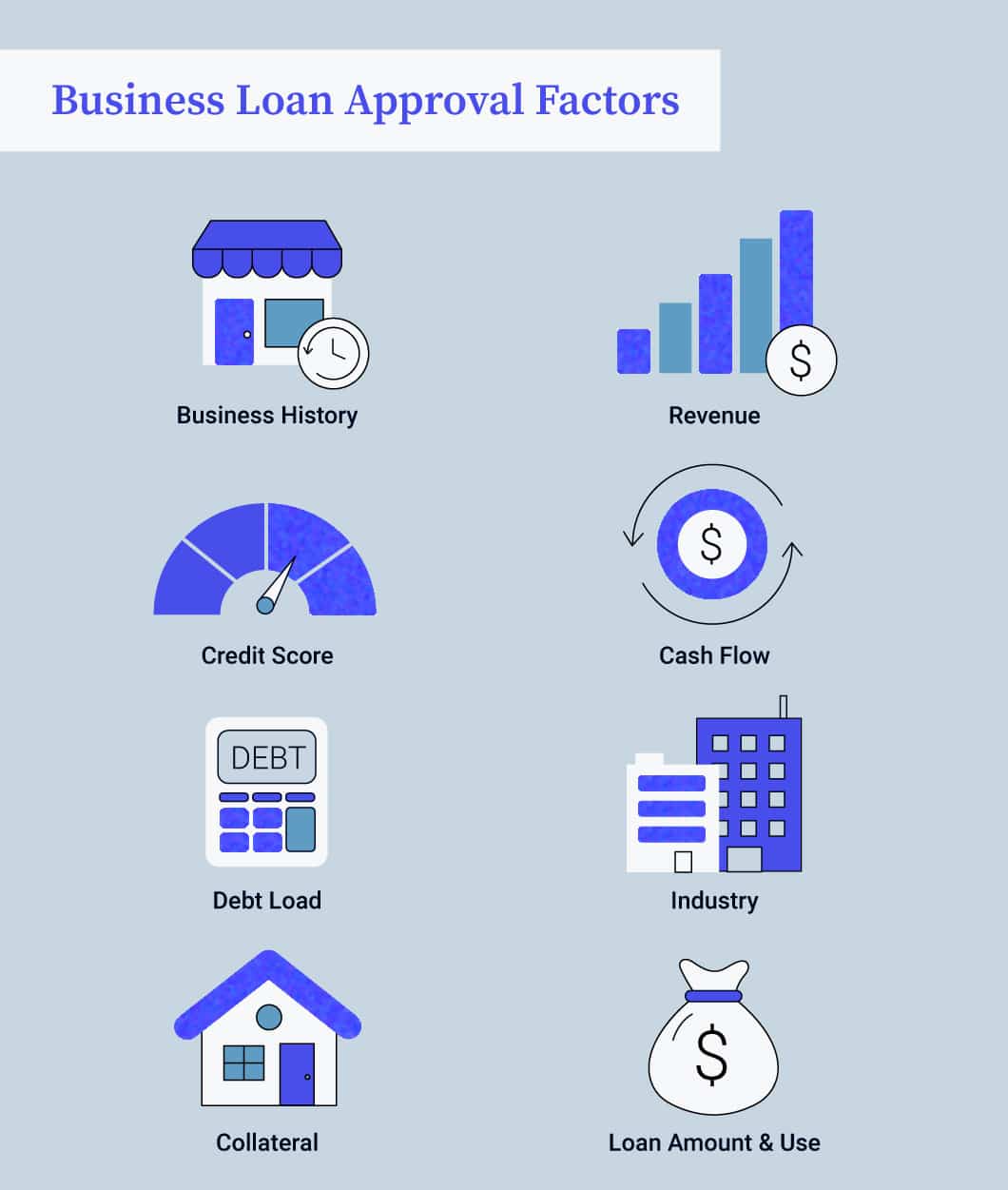

When examining your borrowing from the bank skill and you may loan amount, we are going to describe how the lender works out your ability to repay the mortgage if you choose to use, if in case requisite, suggest exactly how handmade cards as well as their limitations can increase or drop off your borrowing potential.

Finest financial prices

It’s easy to assume that the best payday loan cash advance Shiloh home loan rates are definitely the ones into the lowest interest rate, but that’s not always the fact. In many cases, an extremely low interest rate come with charge and you will charge and you may financial limits that produce this product a great deal more expensiveparison costs inform you the real interest rate however, commonly consumers was won over from the the advertised interest and don’t cause for the other issue that increase your loan repayments. Certain loan providers put margin to their prices by the month-to-month costs and you will charges, charges for extra repayments, offset account and you can redraw institution. We provide the full tool investigations with every hidden fees and you may charges so you’re able to contrast home loans when you look at the Quarterly report precisely.

To invest in Inside the Questionnaire

New Questionnaire property market has changed significantly during the last several many years, especially in areas of the brand new Sydney CBD, the brand new North Coastline, Western Suburbs and you may North Suburbs. Entering the Quarterly report property market shall be difficult but here will still be possibilities on outside suburbs out-of Questionnaire. Customers should prevent suburbs where there’s an oversupply out-of accommodations since the loan providers examine these become high-chance, such as from the large 4 finance companies. High-exposure suburbs need places as much as 30% out of consumers, so it is important to speak with a sydney large financial company before performing your house browse. Given Sydney’s large possessions values, getting the lowest financing costs and also additional features like a keen offset membership otherwise redraw facilities are important to make sure your reduce charge and you may fees and, lower the borrowed funds as fast as possible.

Mortgage CALCULATOR

Probably one of the most confusing parts of securing home financing was workouts exactly how much you could potentially obtain and you can what the financing payments will be. Because of this a generic online financial calculator will give home buyers completely wrong numbers and why working with a separate home loan agent in Sydney is key to providing direct information. Whenever calculating the credit skill and you may loan payments, i make sure to have the capacity to pay back the loan and you never continue your own borrowings beyond your spending plans.

Home loan Device Research

If you know how much you could acquire, the next thing is evaluate mortgage brokers to discover the finest mortgage pricing. That have use of more than 40 various other loan providers and you will 100’s various mortgage brokers, Perfect Equity’s program draws investigation right from lenders to be sure we have the brand new home loan products and assessment cost having you to decide on regarding.