Virtual assistant loan eligibility to have members of the fresh Federal Guard

All of our Federal Protect play such as for example a crucial role within our country’s protection, and so they are entitled to become managed as equivalent borrowers with all of most other Experts. All of us Federal Shield and you may Put aside soldiers very first gathered accessibility new Veterans Administration (VA) home loan benefit from inside the 1992. However, rules has gone by within the 2020 a newer Va loan qualifications law called the Johnny Isakson and David P. Rowe, Meters.D. Veterans’ Medical care and you will Benefits Update Act away from 2020.

National Protect Va Financing Qualification

What is actually this suggest? This means active-duty provider players and you can Federal Protect players can access an identical Virtual assistant financing gurus with assisted generations regarding veterans and you may effective-duty service members reach the American think of owning a home. This enables members of brand new federal guard to use the Va financial far, far earlier than they otherwise would-have-been able to in earlier times.

Very, to get a property is a huge contract, regardless if you are an experienced or not, as well as for those in the brand new Federal Protect which, over the past number of years, have been called to your action to have from natural disasters and you will insurrections on the DC urban area on Covid-19 malware. These folks were installing long hours, not simply are week-end warriors.

The latest no down payment Virtual assistant financing system only turned much more commonly readily available for Western National Shield participants, due to the the fresh law enacted in 2020. So if you see a person in the latest Federal Protect or a spouse of a deceased National Guardsman which could make use of this information this could be an excellent article to generally share.

To purchase property is one of the most high priced purchases really people will previously make. In addition cost together with downpayment, you can find settlement costs, attention, or other charges from the to acquire a house. Although not, buyers currently serving about army or who will be Veterans can be take advantage of an authorities-backed non currency off Virtual assistant home loan.

Virtual assistant Loan Federal Shield Standards

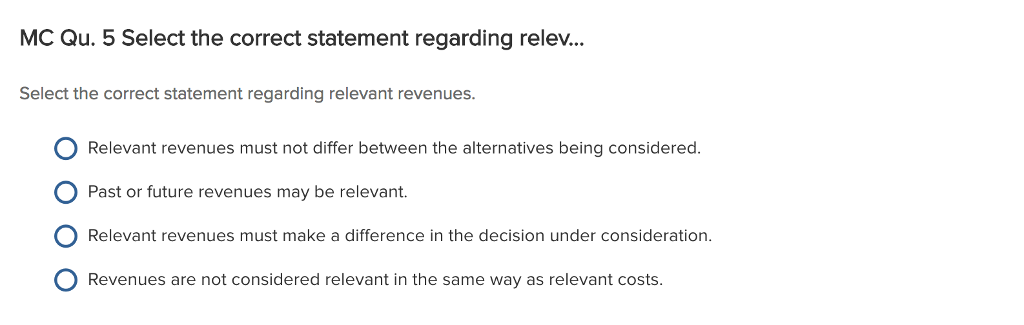

Therefore, before the the fresh laws and regulations. Solely those whom offered about protect would be sensed having the brand new Va financial system if they got 90 consecutive days americash loans Highland Lake of productive service or, had complete six years of provider, any arrived first. Now the fresh endurance try ninety days of full-go out provider, with a minumum of one age of 30 consecutive months.

Making this the change, and this alter is actually retroactively used. And so the national shield business, the usa, rates one to doing 50,000 guardsmen has only gathered fast access the new Virtual assistant loan benefit. Exactly how higher would be the fact!

Identity 32 Va Mortgage Eligibility

Now, if not discover the new law, it offers supply faster, but also provides entry to Federal Protect players exactly who simply have what exactly is named Label 32 obligations, thus Backyard Set aside professionals are usually entitled so you’re able to Energetic Service under several different Sections of Government Rules.

Title 10 and title thirty-two, label thirty two responsibilities are ordered of the governor of the government government or take lay for the services member’s domestic state. Term 10 is actually your order from the fresh president and can be taken getting attributes around the globe. The brand new label 32 obligations must have come performed below certainly one of another section to help you meet the requirements. On this page we shall merely focus on the a couple not you can find about 5 codes in all.

These types of this new Virtual assistant financing qualification statutes just about security your if the you are a national Protect member whether you are training to own university or starting exercises. It’s all covered, however, you will find hardly any products that are not protected by Name thirty two. View here for more information on military solution info.

National Shield Va Mortgage Funding Fee

Va mortgage brokers are supplied by the regulators from the Agency regarding Veterans Affairs (VA). These are generally available to eligible veterans as well as their parents. Virtual assistant finance do not require borrowers to put any cash off, so they’ve been also known as no money off funds.

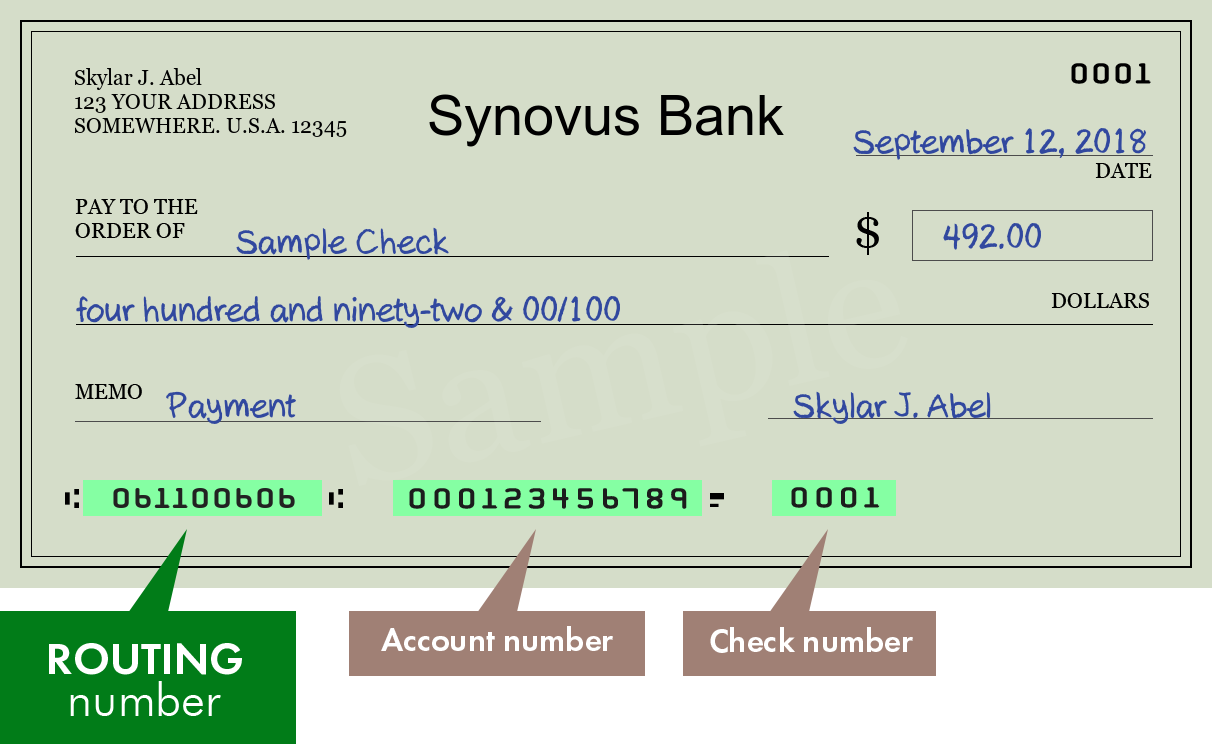

They are doing, not. Still need to shell out an upfront funding percentage to greatly help offset the mortgage prices for You.S. taxpayers. Now the price tag is really as much as 3.6% of your own amount borrowed. The following is a simple chart version of showcasing men and women Virtual assistant resource fees that we was in fact talking about.

Begin with a nationwide Shield Va financing

In order to qualify for a national shield Virtual assistant loan, you ought to first score a certificate out of Qualifications (COE) throughout the Va. Federal Virtual assistant Money makes it possible to do that provide us with a good call at (855) 956-4040 to begin. The brand new Virtual assistant home loan program is actually among the best or even an informed financial device in the market. Start now with a zero down payment Va home loan.