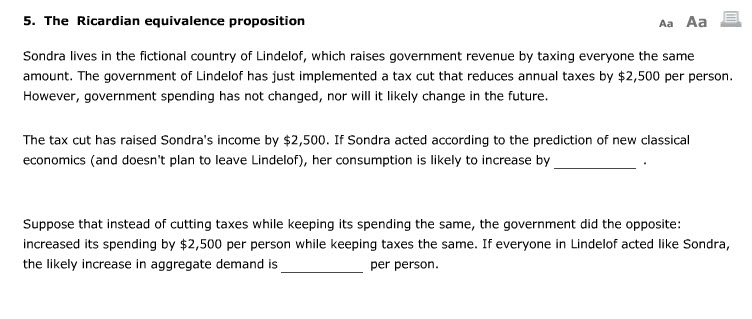

Loan limitations build into the 2022

Accredited borrowers can sign up for huge fund supported by the government-sponsored people – Fannie mae and you will Freddie Mac – brand new Government Houses Administration, and you will Company off Veterans Circumstances.

- Antique mortgage $647,2 hundred

- FHA financing $420,680

- Va mortgage No loan restriction

Although not, you’ve got the ability to obtain a lot more if you’re in the a media to highcost area. In these parts, 2022 compliant and you can FHA mortgage restrictions try near to $one million.

Traditional loan limits for 2022

The new Government Construction Money Company (FHFA) revealed the most compliant loan limits for all mortgage loans obtained from the Federal national mortgage association and you can Freddie Mac computer when you look at the 2022.

To possess site, more 60% of home get money is actually traditional mortgages, thus this type of loan restrictions affect really You.S. home buyers.

The newest max traditional loan restriction for 1-device https://paydayloancolorado.net/mountain-village/ functions for the 2022 prolonged in order to $647,2 hundred for the majority of the nation. That is a reversal from $98,950 or around 18% more 2021’s $548,250.

Mortgage limitations on multi-equipment residences received similar grows. Two-unit home rose so you can $828,700; three-tools so you can $step one,001,650; and four-gadgets so you can $step one,244,850.

The typical compliant limit will be the exact same every where while higher harmony is different from county so you can condition, told you Jonathon Meyer, The mortgage Records mortgage professional and you will licensed MLO.

Essentially, conventional conforming prices are often have the best pricing. For many who bought this current year up until the transform and had to locate a top harmony financing, they might want to consider contacting a lender to find out if they can safe a reduced price.

Segments particularly Kings State, Ny and you may Orange Condition, Ca have average home prices surpassing 115% of your standard loan restriction and are generally aware of the greater conforming loan restrictions.

Alaska, Hawaii, Guam, while the U.S. Virgin Countries features their own gang of financing laws and regulations and can keeps a baseline limitation away from $970,800 using one-device functions for 2022.

FHA financing constraints having 2022

Inside 2022, you can get an enthusiastic FHAinsured mortgage as much as $420,680 for a single-product assets – otherwise as much as $970,800 inside the particularly pricey section.

To have a-two-product household, the product quality FHA home loan limitation is $538,650; to have a three-product family, its $651,050; and you can $809,150 is the cover to own a four-product home.

Alaska, The state, Guam, and also the U.S. Virgin Countries also provide their particular constraints set highest on account of increased will cost you off structure. In those five urban centers, the brand new 2022 baselines are $step one,456,200 for just one-units; $1,864,575 for a few-units; $dos,253,700 for three-units; and you may $2,800,900 to have five-units.

Virtual assistant financing limits cannot exists in 2022

Into the 2020, the brand new U.S. Agencies out of Veteran Factors got rid of maximum amount borrowed it would offer the borrowers. Qualification includes experts, activeresponsibility solution people, National Shield professionals, reservists, and enduring partners.

Virtual assistant financing come towards benefits associated with no expected off percentage otherwise home loan insurance coverage as well as the reasonable rates of interest toward field.

Virtual assistant financing provides an upfront financing fee, and this very individuals tend to roll for the financial settlement costs. Those individuals costs sent more out of 2021 to 2022 as follows:

As to the reasons have the 2022 mortgage limitations increased which can be you to a good a valuable thing?

Brand new Housing and Economic Data recovery Work – established in 2008 following subprime mortgage crisis – requires the baseline loan limitations to-be adjusted every year based on the mediocre You.S. household rate, with regards to the FHFA.

The newest FHFA’s Home Price Directory shot up % per year on the 3rd quarter regarding 2021 so the compliant mortgage limitation improved of the exact same amount.

This is exactly a positive innovation to have customers since increasing loan constraints brings increased total obtain and, in the course of time, more belongings they could probably pay for in the market.

If financing limits weren’t allowed to boost on a yearly basis so you’re able to match home values, first-time and moderate-income home buyers do not have entry to reasonable financial financing, which decrease homeownership opportunities for those who want to buy by far the most, predicated on 2022 California Organization out of Real estate agents Chairman Otto Catrina.

See what mortgage products you qualify for and you can that provides your value, in addition to the latest financial cost right here: