A keen FHA loan is a kind of home loan insured by Government Houses Administration (FHA) very often comes with experts that make the house to purchase techniques easier for first-big date residents.

In this post

- FHA Financing Definition

- Just how FHA Money Works

- Version of FHA Funds

- FHA Loan Professionals & Downsides

- FHA Loan Qualification

- Possibilities to help you FHA Mortgages

- FHA Source and Links

- Faqs On the FHA Financing

A keen FHA mortgage is a mortgage insured from the Government Casing Government (FHA). Such mortgage loans come from personal lenders but they are covered of the FHA and you can conform to the new agency’s simplycashadvance.net can you get a loan with no state id assistance and principles.

That it insurance policies allows banking companies supply financing which have a lot fewer restrictions than traditional funds, as well as the absolute minimum down payment regarding step 3.5% otherwise the absolute minimum credit history from 500.

Trick Takeaways

So you can qualify for an FHA mortgage, you must meet conditions eg having a minimum FICO rating out of 500, an optimum obligations-to-income ratio of 56.9% and you will the absolute minimum deposit off step three.5%.

Conference FHA’s minimal recommendations wouldn’t be certain that acceptance, but the straight down thresholds build FHA money simpler to rating to own the average homebuyer.

Preciselywhat are FHA Money?

An FHA mortgage was home financing given by individual lenders but regulated and you will covered of the Government Construction Administration (FHA). Standards to own FHA financing are more relaxed, such as down payments only 3.5%, credit rating standards less than conventional fund and you will a high mortgage amount, dependent on your local area.

Compared to the conventional loans, FHA loans do have more casual criteria, making them a well-known option for basic-big date homebuyers. FHA loan individuals has a choice ranging from a fifteen- and you can 30-seasons term that have repaired interest levels and a maximum amount borrowed one to may vary according to the state and you can county.

When you find yourself FHA money have many gurus that produce them a lot more available, FHA’s advice need you to carry financial insurance coverage. Home loan insurance coverage handles the fresh new lender’s monetary need for instance your standard.

How does an FHA Mortgage Functions?

The newest You.S. Institution out of Houses and you can Urban Invention (HUD) Federal Housing Power administers FHA mortgage loans. FHA does not lend money to homeowners. Alternatively, it insures money created by personal, FHA-acknowledged lenders.

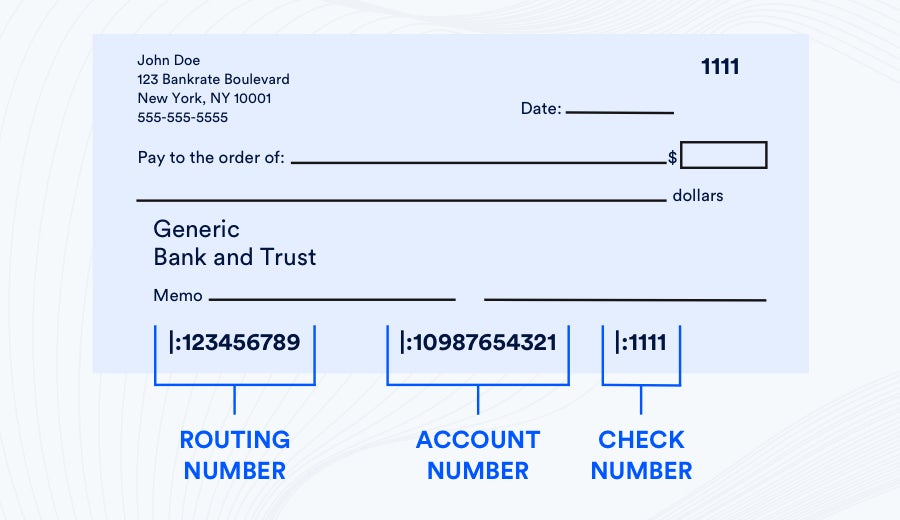

Consumers submit an application for FHA lenders having loan providers such as for instance banks, borrowing unions and you will financial organizations. Lenders underwrite the fresh new loans predicated on FHA advice as well as their individual principles. When the acknowledged, new money are funded by the bank and covered of the FHA.

The latest homebuyer will pay for FHA financial insurance rates. On the home loan insured facing standard, the lending companys likelihood of losings was reduced somewhat. Thus, the lender can be approve mortgages to own homeowners having smaller off repayments.

Looking to determine anywhere between an FHA and you will a traditional (non-government) home loan? Work at the newest wide variety having MoneyGeek’s FHA vs. Traditional Finance calculator.

What are the Types of FHA Fund?

An effective 203(k) financial facts about prices to get the house and the expense of people repairs or renovations it will take. The borrowed funds does away with dependence on financing together with the loan to fund renovations and will be offering just one, long-label option which covers one another means. An effective 203(k) financing will cover individuals rehab will cost you, plus structural improvements otherwise repair, major landscape performs, usage of developments and energy conservation advancements. Although not, luxury additions eg swimming pools and you will tennis process of law would not be shielded.

The fresh new qualifications criteria having a good 203(k) financing are similar to those to possess a keen FHA mortgage, so it is ideal for basic-go out homebuyers who want to get an affordable assets that really needs some performs.

Property Collateral Transformation Home loan (HECM) is actually for the elderly just who actually have a home with a significant level of equity. The fresh HECM is actually an opposite financial you to definitely lets you move your own residence’s security so you can dollars. Getting entitled to a great HECM, you must be at the very least 62 yrs . old and live-in the home youre credit against. You should along with have indicated the financial ability to pay back the mortgage while nonetheless and work out timely repayments towards people possessions fees.