Attempting to sell an automobile that is nevertheless toward mortgage might be difficult until the mortgage number is wholly paid from the financial. However, it’s just not entirely hopeless. For example cause or other, some body will often have to sell the car before financing is actually repaid. There are certain solutions you can look at this kind of a situation.

This guide will assist you to understand how to sell an auto having financing. Given your role, you can choose the choice you personal installment loans for poor credit Victoria like.

In the event that for any reason you need to promote your car ahead of your own auto loan was paid, check out a method to accomplish that for the Dubai.

Pay the Financing

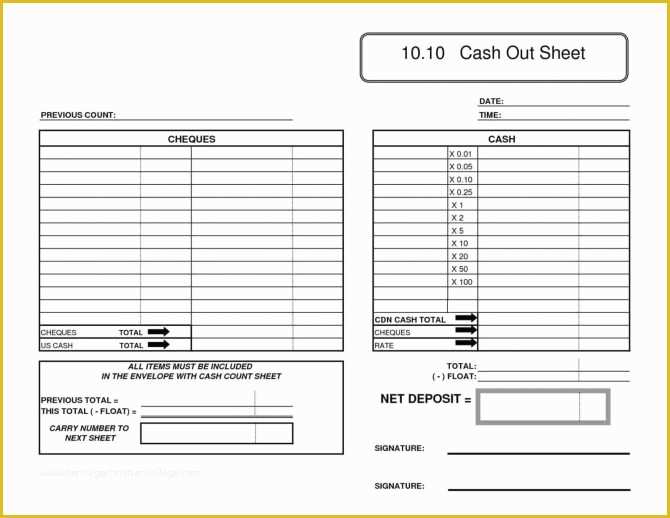

People that have enough money for clear the borrowed funds can simply offer a vehicle with bank financing by paying it. After you’ve cleaned the balance, do the following anything:

- To start with, make sure your financial need certainly to digitally notify the RTA regarding the fresh clearance of mortgage. Just remember that , it will require a number of working days to complete the method.

- And, don’t neglect to request the bank to discharge an official letter of listing. Its a very essential action that not of a lot auto owners know about they.

Find a funds Buyer

Whenever you be able to obvious the balance, follow the the latter strategies. But not, if you fail to obvious the debt, you will also have two methods for you to decide to offer their loan automobile into the Dubai.

- Pick a purchaser who wants to buy your car through bank loan and that’s willing to find the exact same lender significantly less than and that your car or truck is found on the borrowed funds.

- For many who be able to find a fund client for the vehicle, then chances are you have to change the financial institution so they will transfer the mortgage into the visitors. In addition to Emirates NBD, Noor Lender and Dubai Islamic Lender, few other banking companies on the UAE offer financing import plan. Therefore, you ought to see the bank’s plan and you will consider when it choice are feasible for you.

- When you are completed with the borrowed funds import techniques, ask the consumer to try to get a credit card applicatoin and then have it passed by their financial.

- The bank will require a car valuation certification to prove in the event that the worth of the car justifies the fresh new amount borrowed.

- When your buyer keeps agreed upon an asking price that’s unlike your own outstanding debt total, then you certainly need certainly to ask your financial to settle it by using the brand new buyer’s loan. The rest equilibrium could be an earlier payment fee that is usually 1% of one’s amount borrowed.

- Now it’s time transfer the fresh ownership of the auto on the new buyer by visiting a keen RTA otherwise Tasjeel centre.

- Finally, ask the buyer to offer the the brand new membership card to the lender together with a copy of comprehensive insurance coverage. Both everything is expected while the evidence of possession and intimate the loan correspondingly.

Look for a money Visitors

An alternative choice to have selling a financed vehicle would be to pick a finances buyer who’s prepared to pay the loan so you’re able to the bank for you. Yet not, you ought to to make certain the buyer that they’re going to get ownership from the vehicle once clearing the fresh new a good loan amount. To achieve this, attempt to:

Choose for a motor vehicle-Mortgage Shell out-out

History however minimum of, another option to own promoting a vehicle around funds during the Dubai are an automible-mortgage spend-aside. Emirates NBD hitched with dubizzle Specialist provide a convenient vehicles financing solution AUTOSWAP’ for the Dubai. It allows sellers to market their financed vehicle during the Dubai in the place of having to accept their present financing. With this particular feature, the buyer becomes a different sort of loan to finance so it buy. Additionally, Emirates NBD users normally avail 100 % free posts and investigations attributes having dubizzle Pro.

The new faithful professionals becomes touching you once you fill out the online function. Also, the rate of the loan services begins out of dos.99%, given that amount borrowed is up to 80% of your own vehicles valuation. Listed below are some useful tips to market an automobile on the internet when you look at the brand new UAE.

Here are a few significantly more suggestions to offer an auto. This advice can assist you to know how to ready your car available.

The newest Data You’ll need for the buyer

This stops the book for you to offer an automobile having a loan during the Dubai. While you are promoting a car first time about UAE be sure to know all the ways from selling it. And, potential buyers selecting to find an auto without financing can be purchase put vehicles within the Dubai out of dubizzle. Off luxurious put Mercedes Benz and you will BMWs obtainable so you can reasonable second-give Nissans, you can find a popular type of put automobile here. After you pick an automible, do not forget to end up being advised regarding the traffic fines in Dubai.